EUR/USD hovers around 1.09 ahead of Powell after Fed 0.25% expected hike

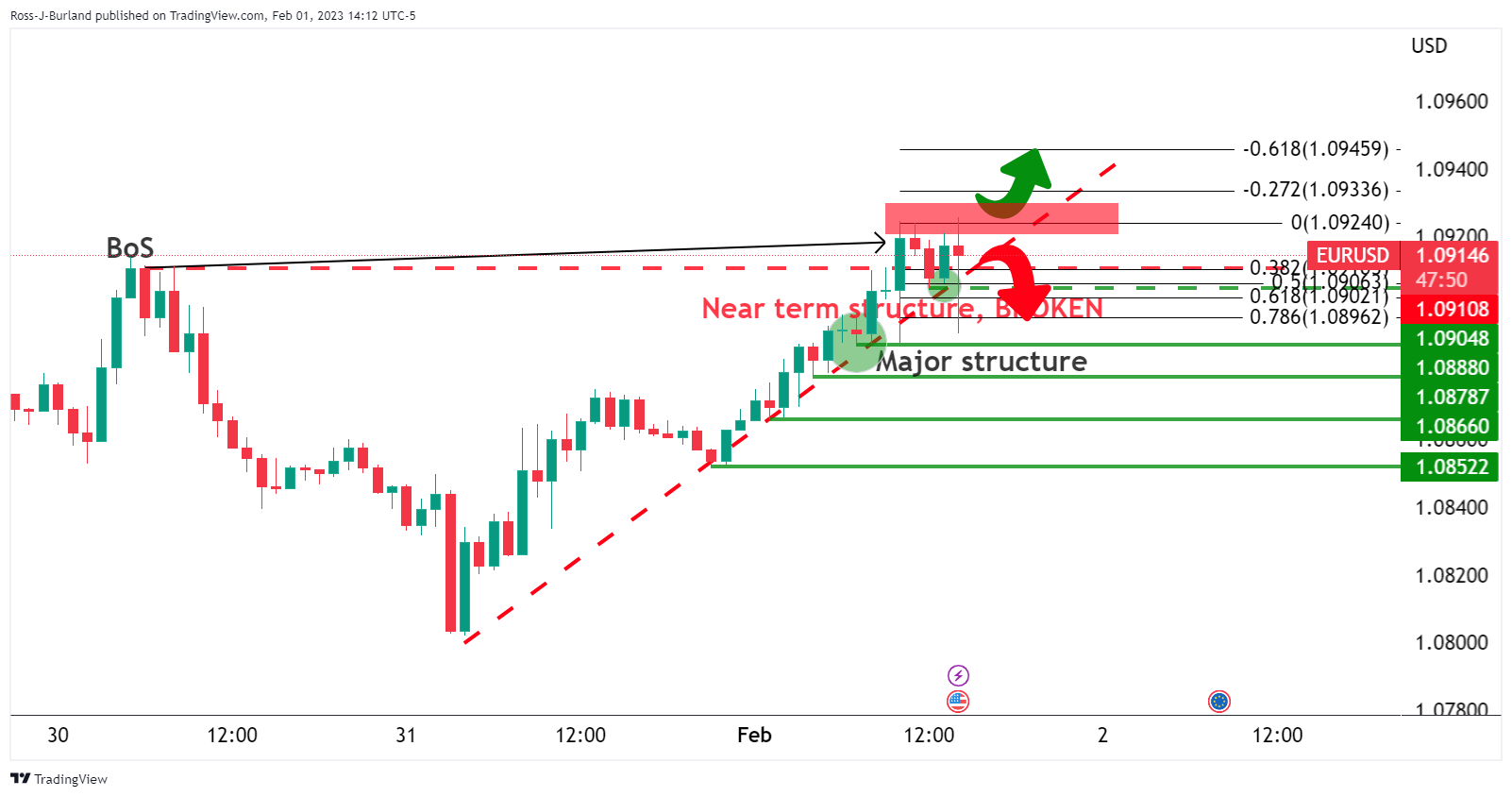

- EUR/USD is biased to the downside as it takes out the near-term structure around 1.0905 after the Fed interest rate decision.

- The Fed chairman Jerome Powell will be the next event that would be expected to cause more volatility and determine the direction of the Euro ahead of the ECB.

EUR/USD is bouncing around 1.0900 after the Federal Reserve raised interest rates for the eighth time in a year, but slowed its pace to a quarter of a point in a nod to an improved inflation outlook.

Federal Reserve statement

Key notes:

- FOMC policy vote was unanimous, to continue balance sheet reduction as planned.

- Reaffirms policy framework, and inflation target.

The Fed is retaining its prior language in the statement and Fed fund futures are still pricing in rate cuts this year, with the Fed funds rate seen at 4.486% by end of December, unchanged prior to the Fed decision. The March meeting is priced in at 85% for 25 bps with the remainder at no change.

Next up will be Jerome Powell who speaks to the press.

Watch live: Jerome Powell's presser

EUR/USD technical analysis

As per the pre-Fed analysis made ahead of the Tokyo open on Tuesday,

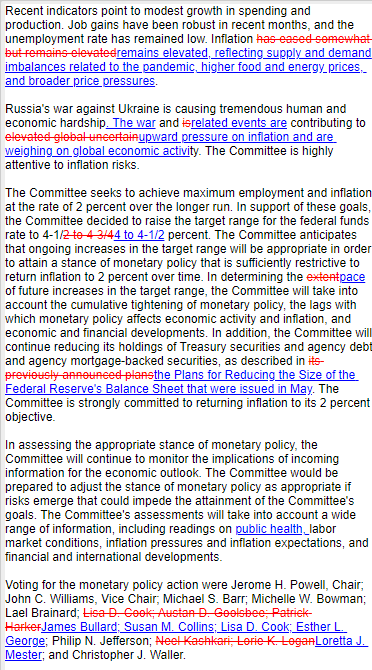

EUR/USD H4 chart, prior analysis:

The price has broken the structure, leaving the bias to the upside for the sessions ahead of the Federal Reserve. It was stated that the support came in near a 38.2% Fibonacci retracement of the prior bullish 4-hour impulse where a correction could be expected to decelerate. This comes in at 1.0850. On the upside, 1.0900 came in at the target with 1.0920 above there as a potential liquidity zone into the Fed.

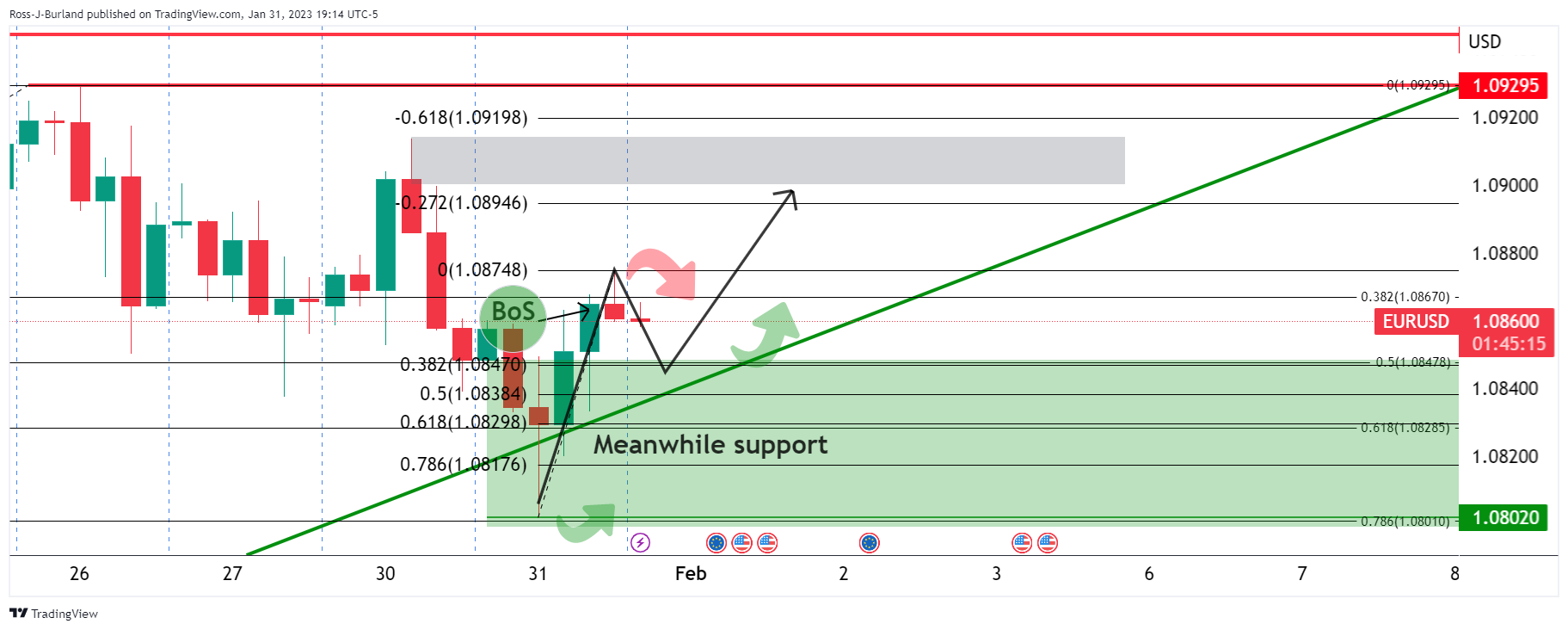

EUR/USD update

The price behaved accordingly and was pumped up to sweep liquidity through 1.0900 as forecasted, conveniently poised for either a sell-off around the Fed or a continuation of the move having already broken resistance structure.

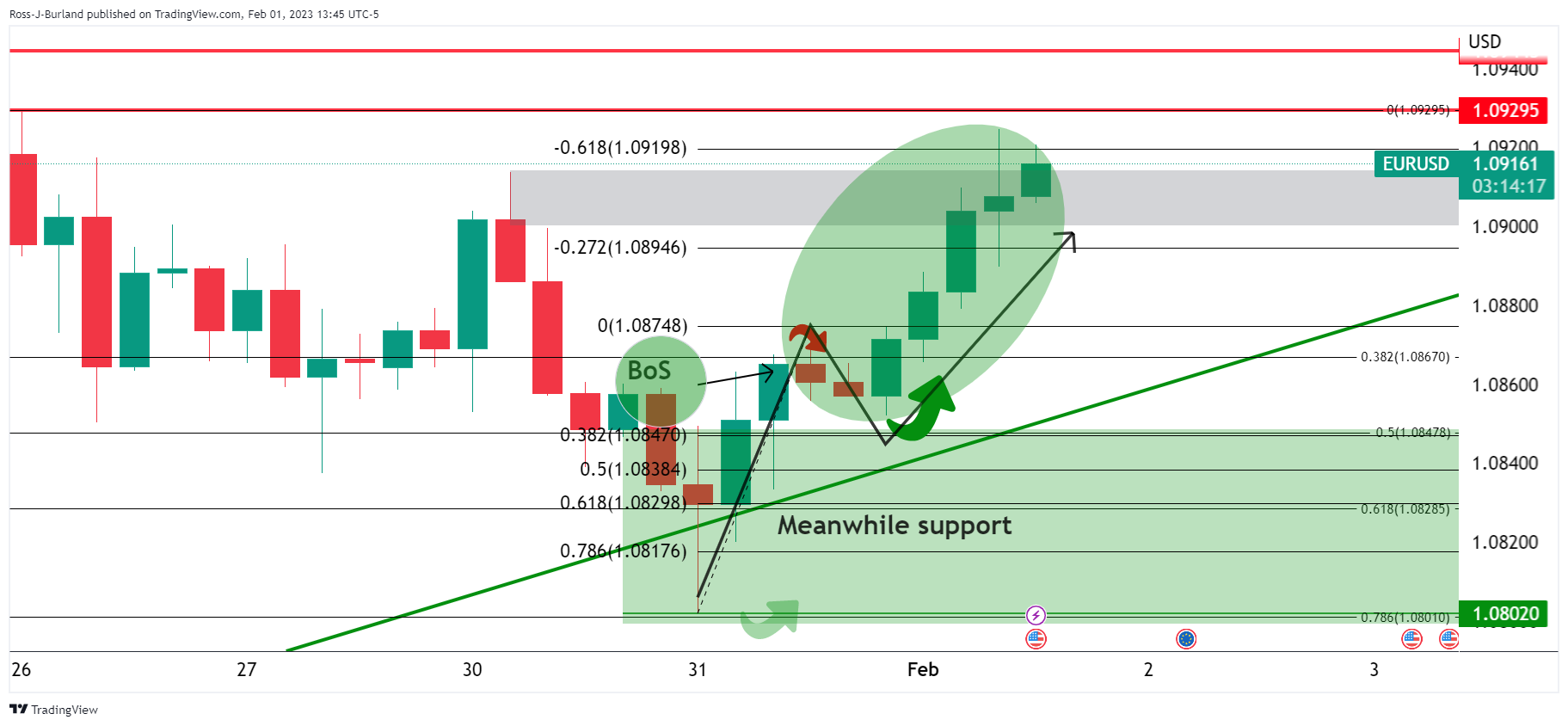

EUR/USD post-Fed interest rate decision and statement

Before the announcement and statement, the price was sitting in a 50% mean reversion area on the hourly chart, on the front side of the bullish dynamic support. Given it had already broken structure to the upside, bulls were in place in anticipation of a move up. This left a bearish case for a test of major structure at 1.0888 and a subsequent move lower, trapping the breakout longs. On the other hand, a dovish outcome would have been perceived as bearish for the US Dollar and leave 1.0950 exposed in a -61.8% extension of the recent correction of the prior bullish impulse.

EUR/USD after the Fed, initial knee-jerk reaction

EUR/USD was offered to 1.0891 (breaking through technical structure again) on the knee-jerk of the Federal Reserve announcement. The price then attempted a move higher in volatility around the decision to hike just 25 basis points, touching a fresh higher for the day of 1.0925. It has now made a fresh session low of 1.0891 at the time of writing as the bears move in for the kill. This leaves the bias to the downside into the Fed chair's presser. However, should he fail to convince markets should he attempt to push back prospects of a pivot later this year, then the Euro could take off and break the 1.0920s resistance as explained above on the charts with 1.0950 eyed.