Back

1 Feb 2023

GBP/USD bulls are moving in around Fed Powell who is stirring up a US Dollar storm

- GBP/USD has rallied around Fed' Powell's presser and opening statement.

- The US Dollar is volatile around the event.

GBP/USD has rallied to a high of 1.2361 so far despite a hawkish Federal Reserve chairman Jerome Powell turning the screw with regard to inflation targets following the Fed's interest rate decision. The central bank raised interest rates for the eighth time in a year but slowed its pace to a quarter of a point in a nod to an improved inflation outlook.

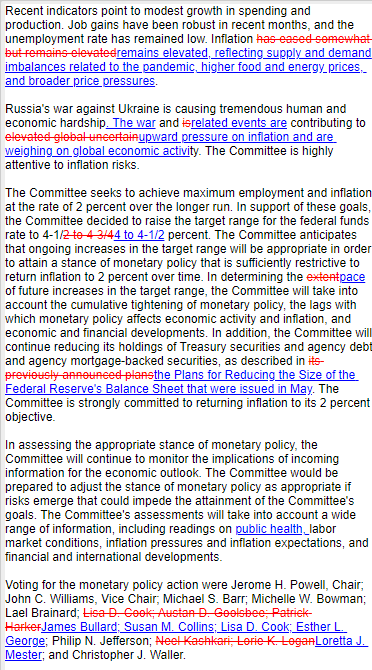

Fed statement

Key notes:

- FOMC policy vote was unanimous, to continue balance sheet reduction as planned.

- Reaffirms policy framework, and inflation target.

The Fed is retaining its prior language in the statement and Fed fund futures are still pricing in rate cuts this year, with the Fed funds rate seen at 4.486% by end of December, unchanged prior to the Fed decision. The March meeting is priced in at 85% for 25 bps with the remainder at no change.

Fed Powell's presser

Key notes so far:

-

Powell speech: History cautions against prematurely loosening policy

-

Powell speech: Well-anchored longer-term inflation expectations not grounds for complacency

-

Powell speech: Will likely have to maintain restrictive stance for some time

-

Fed Press Conference: Chairman Jerome Powell speech live stream – February 1

More to come...