USD/JPY retakes 106.00 and above ahead of US data

- Spot bounces off 105.50.

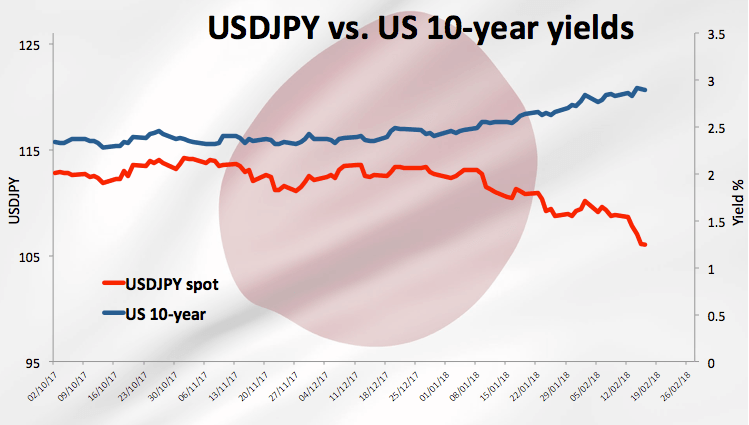

- US 10-y yields around 2.90%.

- US housing data, U-Mich next on tap.

The bid note around the Japanese currency stays unabated so far this week, dragging USD/JPY to fresh 15-month lows in the mid-105.00s during early trade.

USD/JPY looks to data, yields

Spot has trimmed part of its earlier losses although it remains in the red territory on Friday, posting its fifth consecutive decline and always against the backdrop of an increasing offered bias in the buck.

Additionally, yields of the key US 10-year benchmark are hovering over the 2.90% area, some 5 bp lower than fresh cycle tops near 2.95% recorded earlier in the week. The pair, however, seems to have divorced from performance in US yields since the start of the current year.

News from Japan cites H.Kuroda has been appointed Governor for yet another term. Kuroda has once again defended the ultra-loose monetary stance and re-asserted his confidence that inflation will reach its 2% target (eventually, yes…).

In the US data space, preliminary U-Mich for the month of February will be the salient event today seconded by January’s housing starts and building permits.

USD/JPY levels to consider

As of writing the pair is losing 0.06% at 106.06 facing the next support at 105.55 (2018 low Feb.16) seconded by 102.54 (low Nov.3 2016) and finally 101.15 (low Nov.9 2016). On the other hand, a breakout of 108.12 (10-day sma) would expose 108.90 (21-day sma) and then 110.48 (high Feb.2).