GBP/USD holds 1.4040 post-US-data

- The US Core Personal Expenditure (PCE) failed to impress the market.

- The GBP/USD hovering near daily lows, remains vulnerable to the downside.

The GBP/USD is trading at around 1.4054 virtually unchanged on Thursday so far as US data just released with the Core Personal Expenditure (PCE) year on year for February matched original estimates and stood at 1.6%. The US Dollar Index is being supported at the $90 mark.

After finding resistance at 1.4083, the GBP/USD pair´s reaction to the US-data was pretty muted so far as the Cable is trading about 20 pips lower after the macroeconomic news.

Earlier in the European session, the final revision of the UK Gross Domestic Product came in line with expectations at 0.4% quarter on quarter and at 1.4% year on year in the last quarter of 2017. It is worth noting that the Bank of England stays data dependent and “were the UK economy to regain some of its ‘cyclical swagger’ – and the data outperform the broadly low expectations of investors – we would expect sentiment for two BoE rate hikes in 2018 to gain further traction.” according to analysts at ING.

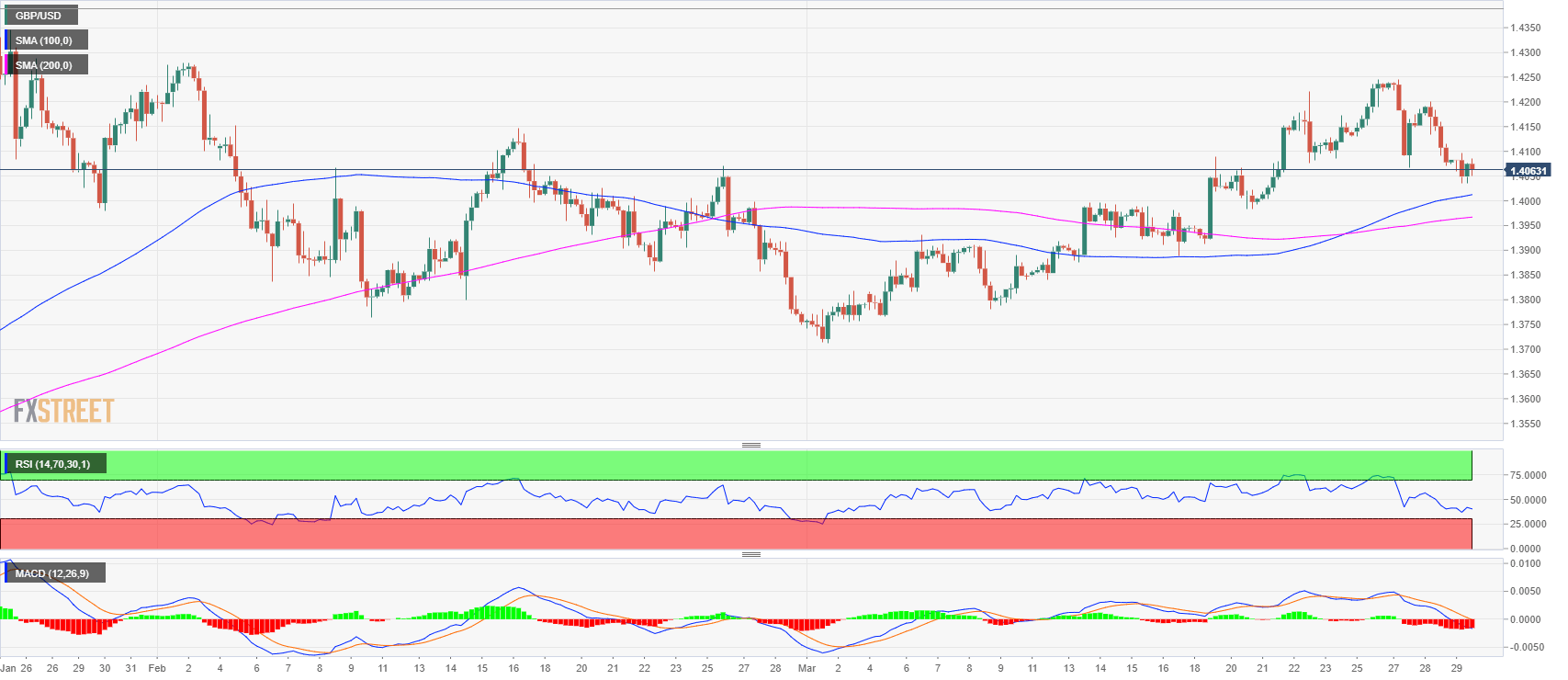

GBP/USD 4-hour chart

Support is seen at the 1.40 last significant swing low, followed by the 1.39 handle while resistance is seen at 1.41 and 1.4150, previous supply/demand levels.