Back

13 Nov 2018

GBP/USD Technical Analysis: Looking for lift, but bidders remain off-balance

- The GBP/USD pairing is trading just shy of the 1.2900 handle, a level that Sterling bulls are focused on as they try to shrug off Brexit angst and regain bullish control of the GBP/USD, but intraday action sees the pair remaining constrained within the low end despite multiple runs above 1.2900.

- GBP/USD has a clear range amid the Brexit endgame, jobs report — Confluence Detector

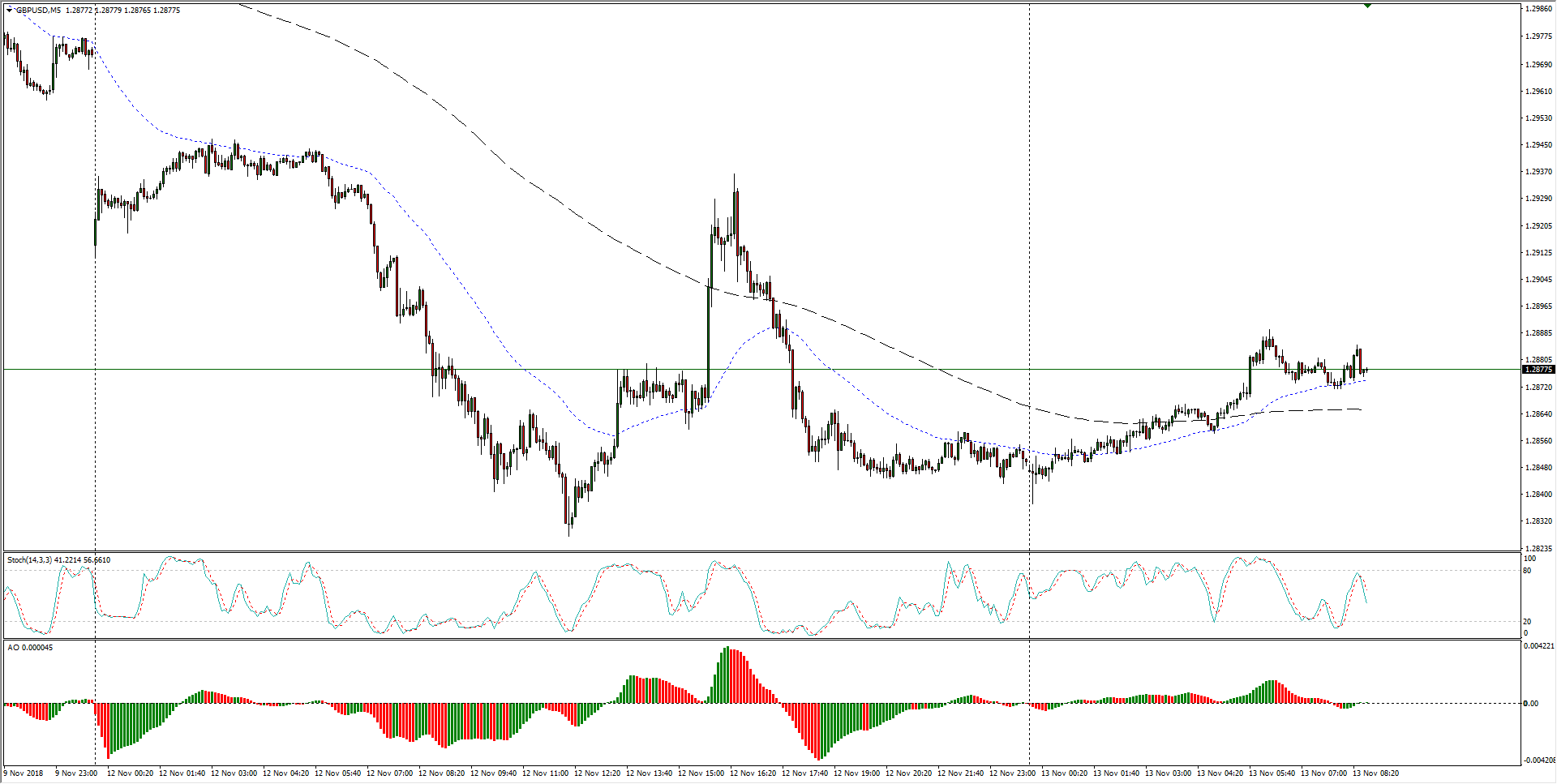

GBP/USD M5

- Recent weeks have seen the GBP/USD slip into a bearish stance, with the current week's action forming a disconnected island chart pattern off of the week's opening bearish gap, and upside momentum is seeing challenges from the 50-period moving average.

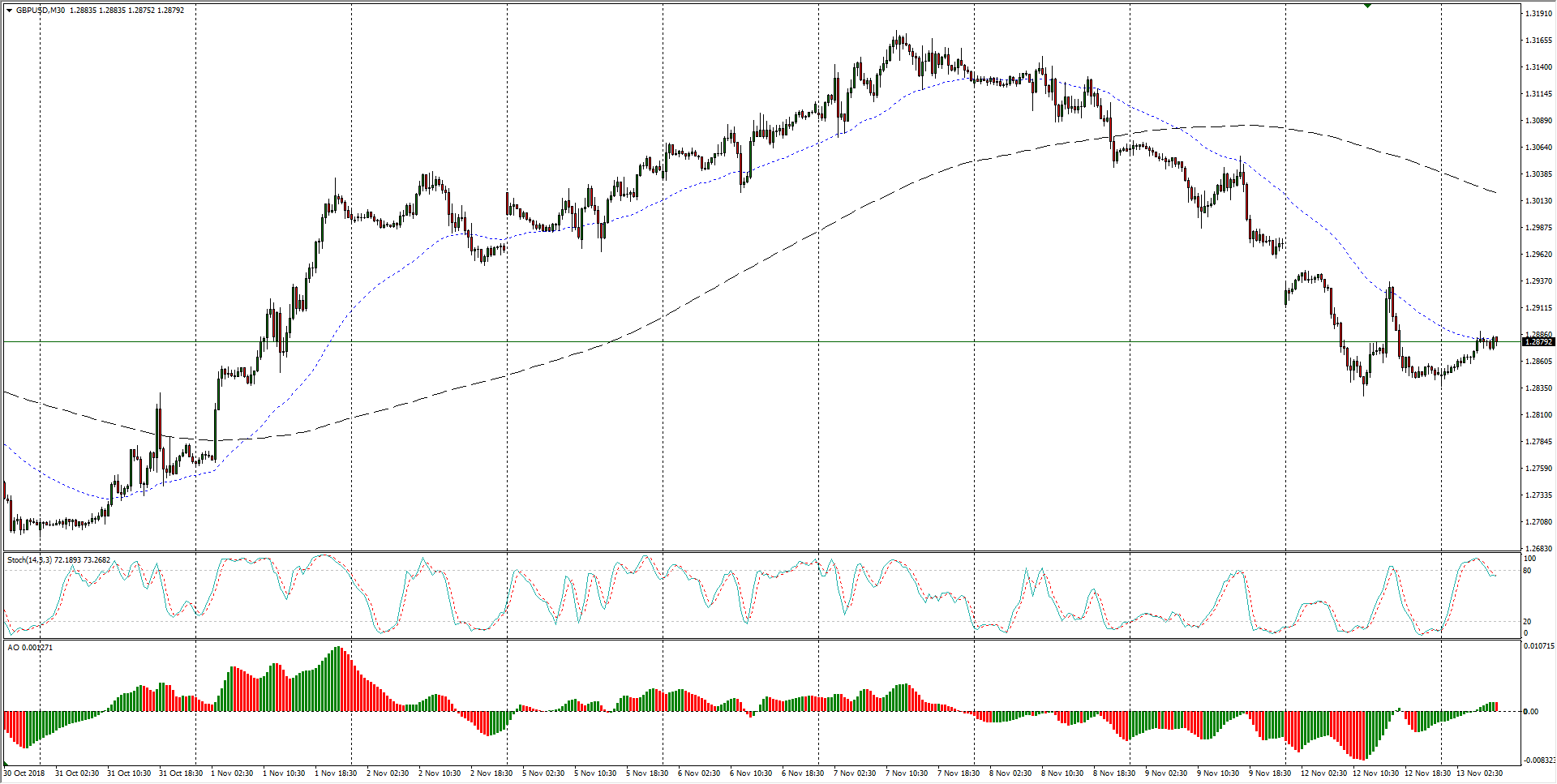

GBP/USD M30

- The past two months have left the Cable spiraling in a rough sideways range, and with technical indicators picking up from oversold levels, any bullish momentum will see resistance from the 38.2% Fibo retracement level at 1.2960.

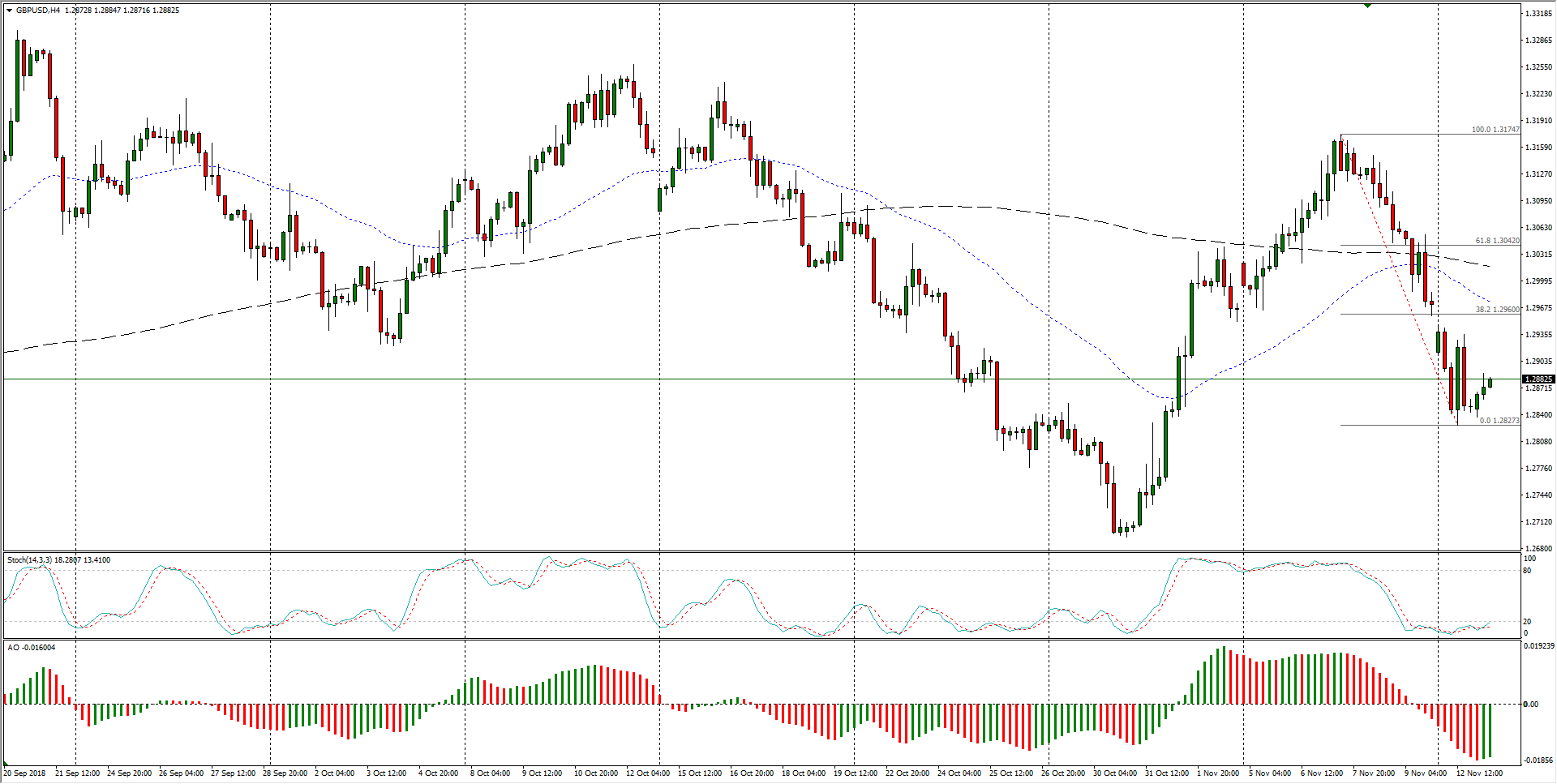

GBP/USD H4

GBP/USD

Overview:

Last Price: 1.288

Daily change: 27 pips

Daily change: 0.210%

Daily Open: 1.2853

Trends:

Daily SMA20: 1.2963

Daily SMA50: 1.3032

Daily SMA100: 1.303

Daily SMA200: 1.3396

Levels:

Daily High: 1.2948

Daily Low: 1.2827

Weekly High: 1.3176

Weekly Low: 1.2958

Monthly High: 1.326

Monthly Low: 1.2696

Daily Fibonacci 38.2%: 1.2874

Daily Fibonacci 61.8%: 1.2902

Daily Pivot Point S1: 1.2804

Daily Pivot Point S2: 1.2755

Daily Pivot Point S3: 1.2683

Daily Pivot Point R1: 1.2925

Daily Pivot Point R2: 1.2997

Daily Pivot Point R3: 1.3046