Dollar Index Technical Analysis: DXY's struggle for direction continues

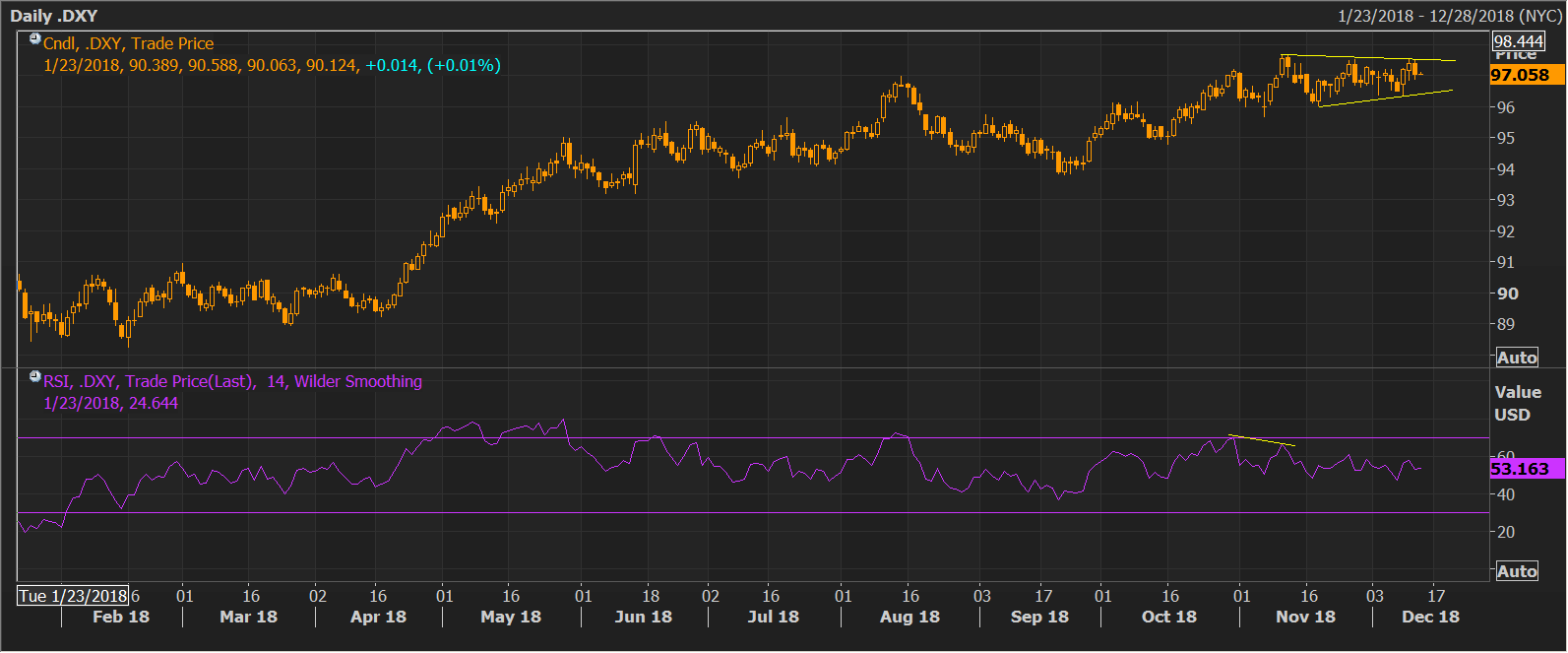

- The dollar index (DXY), which tracks the value of the greenback against majors, hit a high of 97.69 on Nov. 12 and has struggled for direction ever since.

- As of writing, it is seen at 97.06 and is trapped in a narrowing price range or a symmetrical triangle pattern.

- A break below 93.64 would imply range breakdown and validate the bearish divergence of the 14-day RSI (confirmed on Nov. 12) and hence could yield a drop to support at 95.00.

- A daily close above 97.53 would confirm a symmetrical triangle breakout and open the doors to 98.50 (May 8, 2017 low).

- A symmetrical triangle looks more likely, courtesy of dovish Fed expectations and falling haven demand amid the rising odds of US-China trade deal.

Daily chart

Trend: Neutral

Dollar Index Spot

Overview:

Today Last Price: 97.06

Today Daily change: 1.0 pips

Today Daily change %: 0.0103%

Today Daily Open: 97.05

Trends:

Previous Daily SMA20: 96.9

Previous Daily SMA50: 96.47

Previous Daily SMA100: 95.8

Previous Daily SMA200: 94.18

Levels:

Previous Daily High: 97.49

Previous Daily Low: 96.89

Previous Weekly High: 97.21

Previous Weekly Low: 96.37

Previous Monthly High: 97.7

Previous Monthly Low: 95.68

Previous Daily Fibonacci 38.2%: 97.12

Previous Daily Fibonacci 61.8%: 97.26

Previous Daily Pivot Point S1: 96.8

Previous Daily Pivot Point S2: 96.54

Previous Daily Pivot Point S3: 96.2

Previous Daily Pivot Point R1: 97.4

Previous Daily Pivot Point R2: 97.74

Previous Daily Pivot Point R3: 98