Back

19 Feb 2019

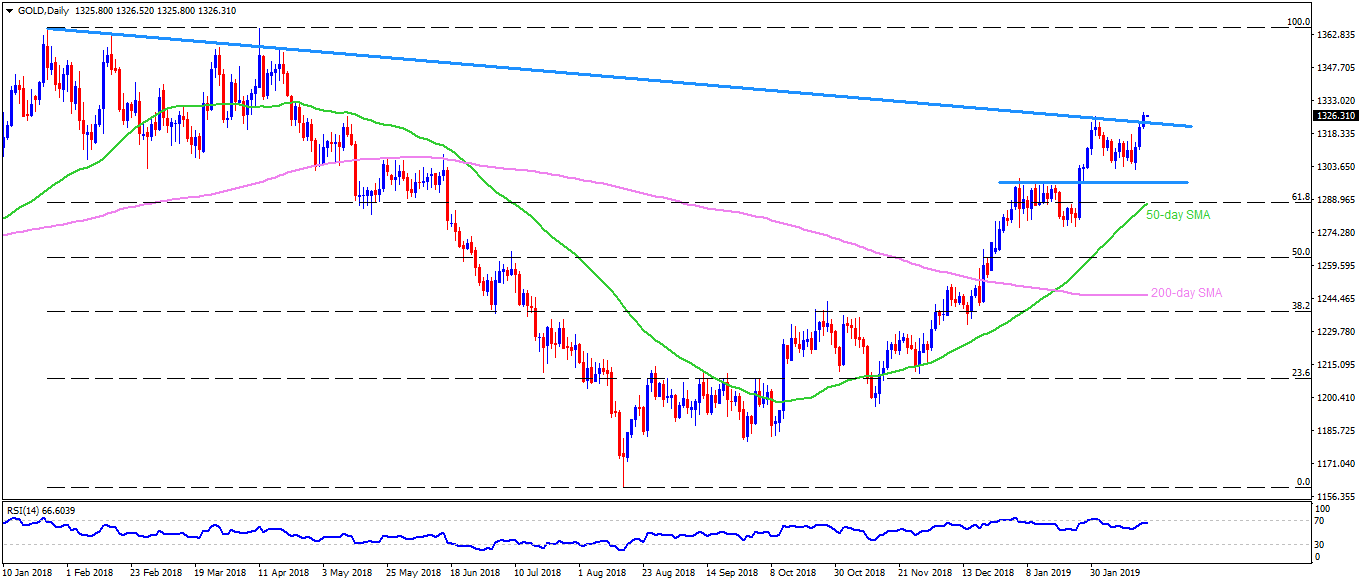

Gold Technical Analysis: $1328 questions 2019 high, $1322 offers immediate support

- Gold trades around $1326.20 at the start of Asian trading on Tuesday.

- The yellow metal surged to the fresh yearly high, also the highest level since April 2018, of $1327.60 on Monday.

- At the start, the bullion seems finding it hard to extend recent upside and hence need to assure buyers with a break of $1328 in order to extend latest increase towards mid-April 2018 lows near $1334.

- Given the quote manage to stretch its rise beyond $1334 on a daily closing basis, $1341, $1349 and $1356 may act as intermediate halts during its rally to 2018 high around $1366.

- Meanwhile, a downside break of resistance-turned-support connecting highs marked since 2018, at $1322, can offer immediate rest.

- If prices dip under $1322, recent upside signal past breakout can be negated with brighter chances of $1316 comeback.

- In case sellers refrain to stop under $1316, $1302 and a horizontal-line joining early January highs, at $1296, become crucial to watch.

Gold daily chart

XAU/USD

Overview:

Today Last Price: 1326.46

Today Daily change: 5.36 pips

Today Daily change %: 0.41%

Today Daily Open: 1321.1

Trends:

Daily SMA20: 1305.66

Daily SMA50: 1285.19

Daily SMA100: 1254.6

Daily SMA200: 1232.57

Levels:

Previous Daily High: 1322.55

Previous Daily Low: 1305.9

Previous Weekly High: 1322.55

Previous Weekly Low: 1303.15

Previous Monthly High: 1326.25

Previous Monthly Low: 1275.9

Daily Fibonacci 38.2%: 1316.19

Daily Fibonacci 61.8%: 1312.26

Daily Pivot Point S1: 1310.48

Daily Pivot Point S2: 1299.87

Daily Pivot Point S3: 1293.83

Daily Pivot Point R1: 1327.13

Daily Pivot Point R2: 1333.17

Daily Pivot Point R3: 1343.78