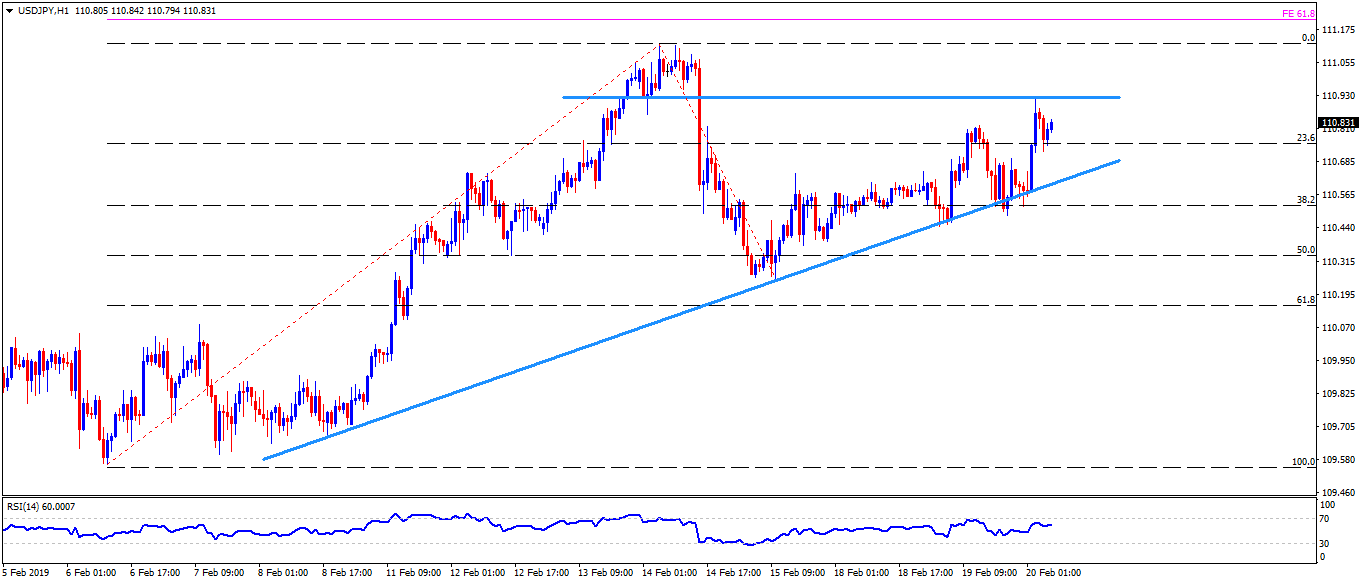

USD/JPY Technical Analysis: 110.90-95 is the key level to beat for the bulls

- USD/JPY trades near 110.85 just before European markets open on Wednesday.

- The pair presently heads towards the 110.90-95 horizontal-region that confined its upside yesterday.

- If bulls conquer 110.95 barrier, recent highs of 111.15 and 61.8% Fibonacci retracement of February 06 to 15 moves, at 111.25, can flash on their radar to target.

- Alternatively, a downside break of 110.60 support-line figure can drag the quote to 110.25 and then to 110.00 rest-points.

- Moreover, pair’s additional weakness past-110.00 can avail 109.85 and 109.55 as supports.

USD/JPY hourly chart

Additional important levels:

Overview:

Today Last Price: 110.83

Today Daily change: 22 pips

Today Daily change %: 0.20%

Today Daily Open: 110.61

Trends:

Daily SMA20: 109.92

Daily SMA50: 110.06

Daily SMA100: 111.55

Daily SMA200: 111.31

Levels:

Previous Daily High: 110.82

Previous Daily Low: 110.44

Previous Weekly High: 111.13

Previous Weekly Low: 109.7

Previous Monthly High: 110

Previous Monthly Low: 104.75

Daily Fibonacci 38.2%: 110.68

Daily Fibonacci 61.8%: 110.58

Daily Pivot Point S1: 110.42

Daily Pivot Point S2: 110.23

Daily Pivot Point S3: 110.03

Daily Pivot Point R1: 110.81

Daily Pivot Point R2: 111.01

Daily Pivot Point R3: 111.2