Back

21 Feb 2019

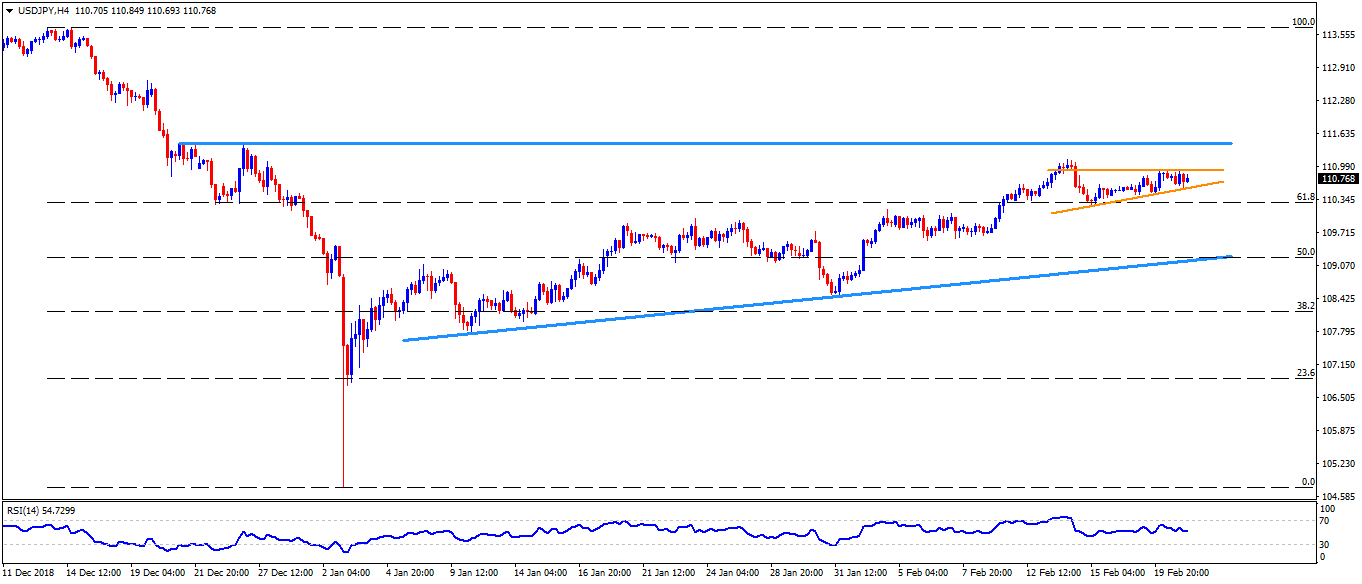

USD/JPY Technical Analysis: Immediate ascending triangle confines the pair moves between 110.95 and 110.50

- The Japanese Yen (JPY) trade near 110.80 against the USD during early Thursday.

- The pair moves have been challenged by the short-term ascending triangle present between 110.95 resistance and 110.50 support.

- Should the pair rallies beyond 110.95 resistance-line connecting present week high to the late February 14 lows, 111.15 and 111.45-50 could quickly appear on the chart.

- In a case prices rally beyond 111.50, 112.10 and 112.60 might please the buyers ahead of challenging them with 113.10 and 113.70 resistances.

- On the contrary, a downside break of 110.50 highlights the importance of 110.00 whereas 109.50 could entertain sellers then after.

- However, an upward sloping support-line joining January 10 and 31 low, at 109.10, may limit the pair’s declines past-109.50.

- Given the bears’ rule trade sentiment under 109.10, 108.50 and 107.70 could flash on their radar to target.

USD/JPY 4-Hour chart

Additional important levels:

Overview:

Today Last Price: 110.74

Today Daily change: 10 pips

Today Daily change %: -0.09%

Today Daily Open: 110.84

Trends:

Daily SMA20: 109.98

Daily SMA50: 110.01

Daily SMA100: 111.51

Daily SMA200: 111.31

Levels:

Previous Daily High: 110.96

Previous Daily Low: 110.54

Previous Weekly High: 111.13

Previous Weekly Low: 109.7

Previous Monthly High: 110

Previous Monthly Low: 104.75

Daily Fibonacci 38.2%: 110.79

Daily Fibonacci 61.8%: 110.7

Daily Pivot Point S1: 110.6

Daily Pivot Point S2: 110.36

Daily Pivot Point S3: 110.18

Daily Pivot Point R1: 111.02

Daily Pivot Point R2: 111.2

Daily Pivot Point R3: 111.44