US Dollar Index remains bid above 98.00, focus on Q1 GDP

- The index extends the rally, holds onto 98.00 and above.

- Yields of the US 10-year note appear capped by 2.54% so far.

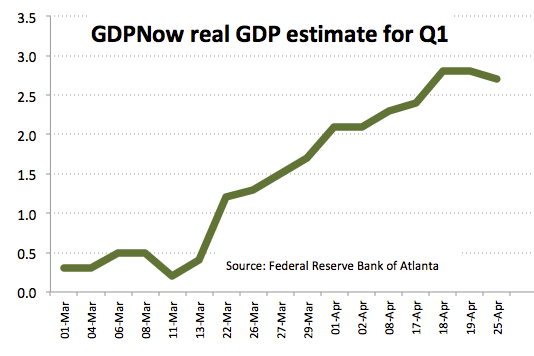

- US advanced Q1 GDP, U-Mich next in the docket.

The greenback keeps the buying interest well and sound so far this week, managing well to stay above the key 98.00 barrier when measured by the US Dollar Index (DXY).

US Dollar Index looks to data

The index is advancing uninterruptedly since Monday, breaking above the 98.00 mark and recording fresh yearly highs in the 98.30/35 band on Thursday, area last visited in May 2017.

The positive atmosphere for the buck in the global markets has been sustained by the changed of heart in market participants plus the increasing deterioration of fundamentals overseas, particularly in the euro area following recent results from the German economy.

Later in the session, the greenback should be in centre stage in light of the publication of the first revision of US Q1 GDP seconded by the final gauge of the U-Mich index.

What to look for around USD

The upbeat momentum in the buck appears sustained by solid prints in the domestic docket as of late in combination with weakness from overseas data, mostly from Euroland, while hopes of a US-China trade deal appears now re-ignited. The last FOMC minutes reinforced the neutral stance of the Fed for the next months, although a rate raise has not been ruled out just yet. On the greenback’s positive side we find solid US fundamentals, its safe haven appeal, favourable yield spreads vs. its peers and the status of global reserve currency. This, plus the Fed’s current neutral/bullish prospects of monetary policy vs. the dovish shift seen in its G10 peers is expected to keep occasional dips in the buck shallow for the time being.

US Dollar Index relevant levels

At the moment, the pair is gaining 0.01% at 98.15 and faces the next hurdle at 98.32 (2019 high Apr.25) seconded by 99.89 (high May 11 2017) and then 100.51 (78.6% Fibo of the 2017-2018 drop). On the other hand, a breach of 97.26 (low Apr.22) would aim for 96.92 (55-day SMA) and finally 96.75 (low Apr.12).