Back

29 Jul 2019

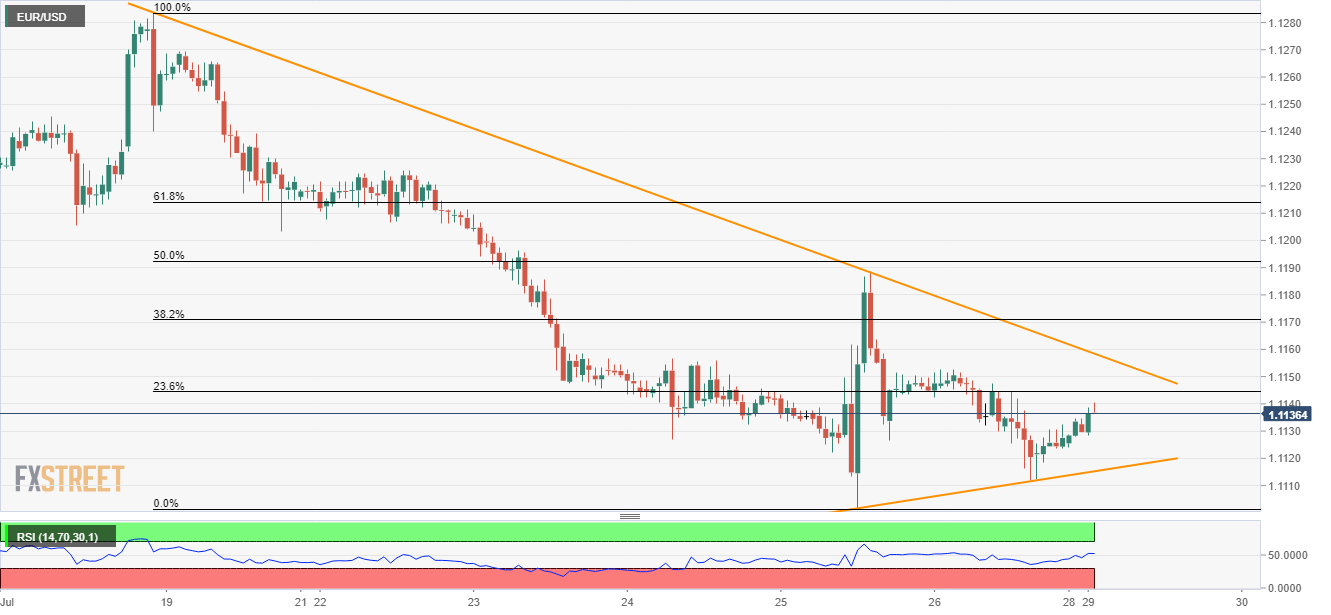

EUR/USD technical analysis: 23.6% Fibo., multi-day long trend-line cap immediate upside

- Immediate ascending trend-line portrays EUR/USD’s recovery.

- 23.6% Fibonacci retracement and a 7-day long descending trend-line limit immediate rise.

Despite recovering gradually during the late last week, the EUR/USD pair is still below key near-term resistances as it takes the rounds to 1.1138 on early Monday.

Among them, 23.6% Fibonacci retracement of a week-long downpour completing on July 25, at 1.1145, followed by 7-day old downward sloping resistance-line, at 1.1158, acts as immediate upside barriers.

Should prices rally beyond 1.1158, July 25 high around 1.1189 and 1.1210 can please buyers.

Alternatively, a downside break of 1.1115 support-line can fetch prices to Thursday’s low of 1.1101 that holds the key to the quote’s south-run towards mid-2017 bottom close to 1.10000 mark.

EUR/USD hourly chart

Trend: Pullback expected