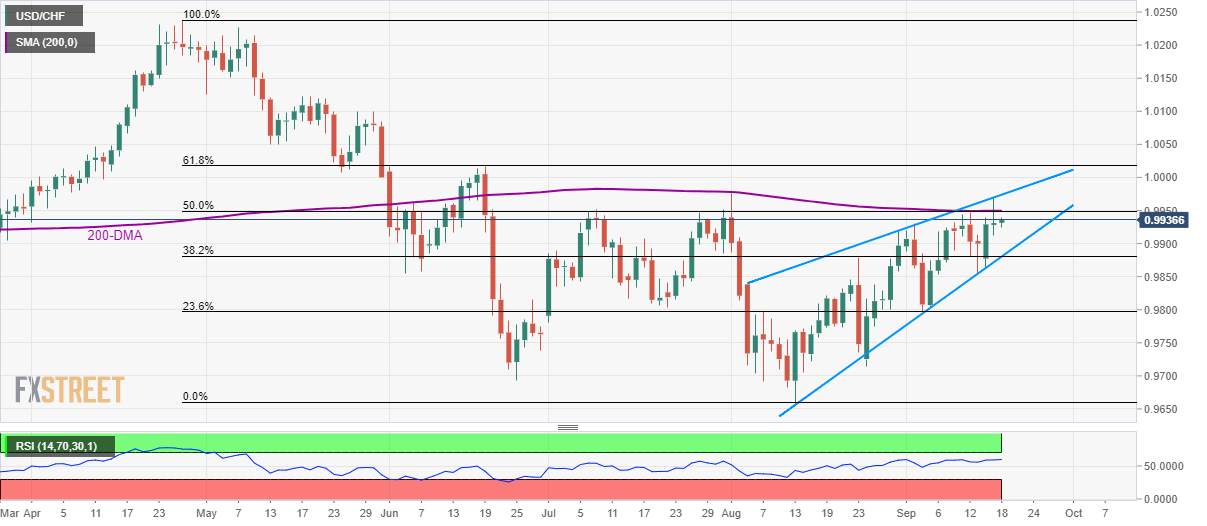

USD/CHF technical analysis: 0.9950 to question buyers inside a rising wedge

- USD/CHF takes the bids inside a six-week-old rising wedge bearish formation.

- 200-DMA, 50% Fibonacci retracement could restrict immediate upside.

- 0.9880 becomes the key support.

Despite the recent rise, USD/CHF trades below the confluence of 200-day simple moving average (DMA) and 50% Fibonacci retracement of April-August declines, close to 0.9940, while heading into the European session on Wednesday.

Even if the pair manages to overcome 0.9950 immediate resistance confluence, upper-line of the short-term bearish rising wedge formation near 0.9975 will be on the buyers’ watch-list as a break of which could propel the quote towards 61.8% Fibonacci retracement level of 1.0017 and then to the May-end tops surrounding 1.0100.

On the downside, 38.2% Fibonacci retracement level and pattern support offer key rest-point around 0.9880 as break of which will theoretically confirm the pair’s south-run towards 0.9770.

However, 0.9800 mark comprising 23.6% Fibonacci retracement could offer an intermediate halt during the declines.

USD/CHF daily chart

Trend: pullback expected