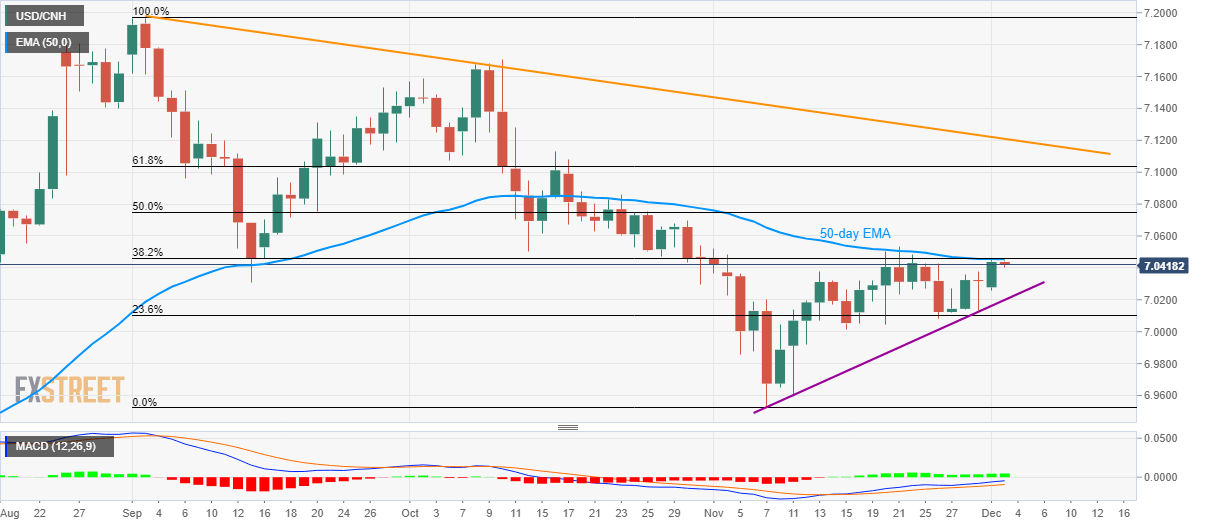

USD/CNH Technical Analysis: Steps back from 7.0456/55 resistance confluence

- USD/CNH nears 50-day EMA, 38.2% Fibonacci retracement.

- A monthly trend line limits the immediate downside.

- 50% of Fibonacci retracement will be in focus after the breakout.

Failure to rise past 50-day Exponential Moving Average (EMA) and 38.2% Fibonacci retracement of September-November fall drag the USD/CNH pair to 7.0427 during early Tuesday.

As a result, prices can revisit an upward sloping trend line since November 07, at 7.0200. However, pair’s further declines make it vulnerable to test November 05 low of 6.9860 and the previous month’s low around 6.9525.

Meanwhile, 12-bar Moving Average Convergence and Divergence (MACD) favors the pair’s run-up beyond 7.0455/56 resistance confluence.

In doing so, a 50% Fibonacci retracement level of 7.0750 and mid-October high near 7.1130 will be on the Bull’s radar.

Though, a descending trend line since early September, at 7.1210 could challenge buyers afterward.

USD/CNH daily chart

Trend: Pullback expected