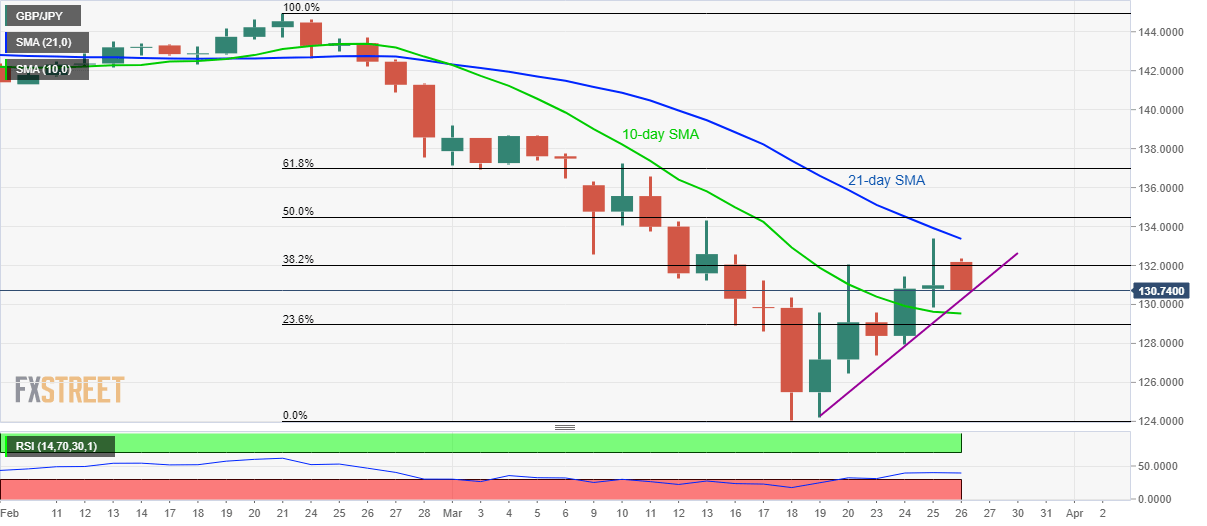

GBP/JPY Price Analysis: Pullback from 21-day SMA recalls sub-131.00 area

- GBP/JPY remains on the back foot after reversing from the two-week top.

- The weekly support line offers immediate rest.

- Key Fibonacci retracements could question buyers beyond 21-day SMA.

Having failed to cross 21-day SMA during the previous day, GBP/JPY declines to 130.74 amid the Asian session on Thursday.

While a one-week-old rising trend line, currently at 130.25, followed by 130.00 round figure, offers immediate supports to the pair, 10-day SMA near 129.50 seems to be the near-term strong rest for the quote.

Should there be a clear downside below 129.50, GBP/JPY prices are less likely to wait before 127.00 whereas the monthly low near 124.00 could be on the bears’ radars afterward.

On the upside, a sustained break above 21-day SMA level of 133.40 will need validation from 50% and 61.8% Fibonacci retracements of the pair’s fall from February 21 to March 18, 2020, respectively around 134.50 and 137.00.

In a case where the pair manages to stay positive beyond 137.00, 138.60/70 could lure the bulls.

GBP/JPY daily chart

Trend: Pullback expected