Back

3 Apr 2020

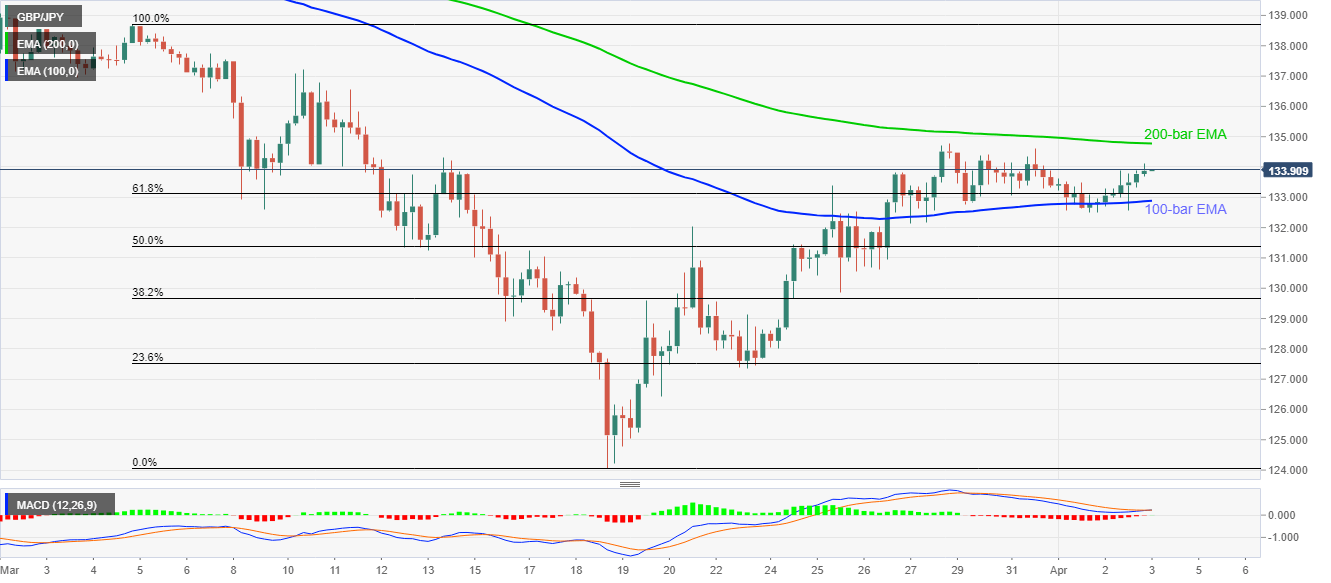

GBP/JPY Price Analysis: Off session top, struggles between the key EMAs

- GBP/JPY remains capped a range despite the recent pullback.

- MACD teasing bulls, sustained trading above 61.8% Fibonacci retracement keep buyers hopeful.

- 50% Fibonacci retracement adds to the supports.

GBP/JPY pulls back from the session tops near 134.10 to 133.75 just as Tokyo opens for Friday’s trading.

The pair stays between 200 and 100-bar EMAs so far during the week while it's sustained trading beyond 61.8% Fibonacci retracement of March month’s drop and MACD conditions seem to favor the buyers.

Even so, a sustained break of 200-bar EMA level of 134.80 becomes necessary for the bulls to aim for March 10 high surrounding 137.20.

On the downside, 61.8% Fibonacci retracement level of 133.10 and 100-bar EMA close to 132.85 could keep the sellers in check, if any.

In a case where the quote slips below 132.85, 50% Fibonacci retracement near 131.40 and 130.60/50 can entertain the bears.

GBP/JPY four-hour chart

Trend: Sideways