AUD/USD Price Analysis: Remains below 200-hour EMA despite upbeat China data

- AUD/USD pays a little heed to China’s Caixin Services PMI.

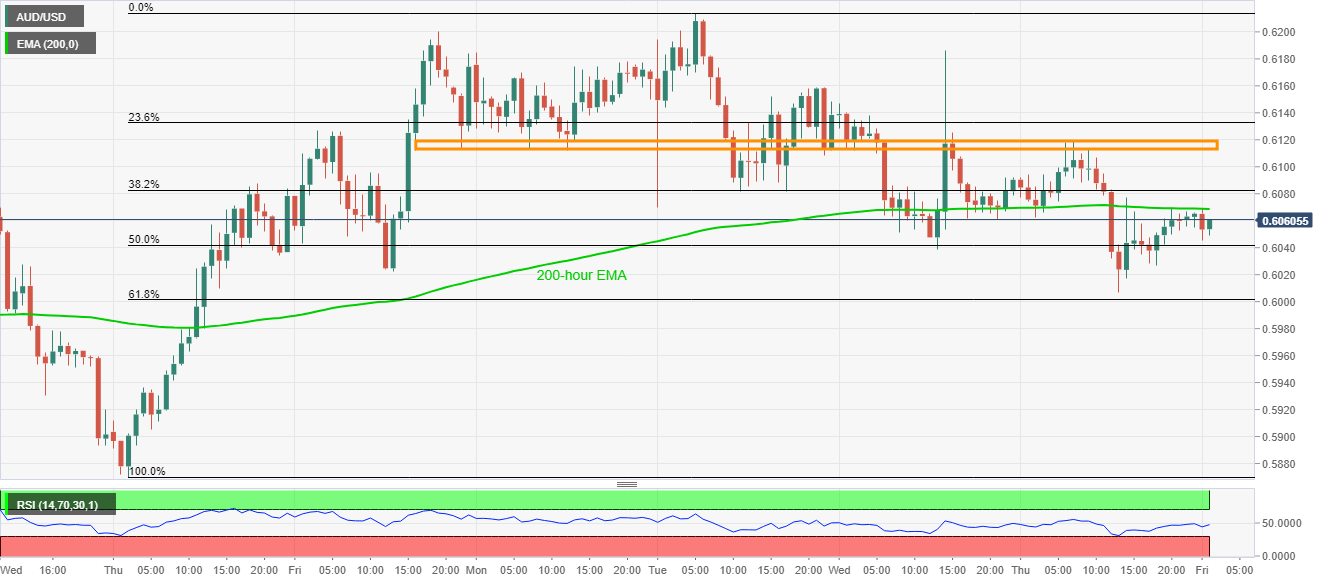

- 61.8% Fibonacci retracement restricts immediate downside.

- Weekly horizontal resistance adds to the upside barrier.

Although China’s Caixin Services PMI becomes another activity data to flash positive figures for the dragon nation, AUD/USD remains modestly in loss to 0.6060 amid the early Friday.

China’s March month Caixin Services PMI rose to 43.00 from 26.5 prior. On Thursday, the Caixin Manufacturing PMI also flashed upbeat data.

Read: China Caixin/IHS Markit March Services PMI at 43.0 vs 26.5 in February

Earlier during the day, Aussie Retail Sales flashed upbeat figures, +0.5% versus 0.4% forecast, but failed to impress the buyers.

That said, trades may again target 50% Fibonacci retracement of March 26-31 upside, at 0.6000, while further downside may take rest around 0.5980.

Alternatively, a sustained break beyond a 200-hour EMA level of 0.6070 needs validation from the weekly horizontal area close to 0.6110/20.

Should AUD/USD prices remain strong beyond 0.6120, March 31 high near 0.6215 will be on the bulls’ radars.

AUD/USD hourly chart

Trend: Bearish