WTI Price Analysis: Bears eye contract low, $10 at risk

- WTI bears aim for $10.00 after more than 13.00% losses.

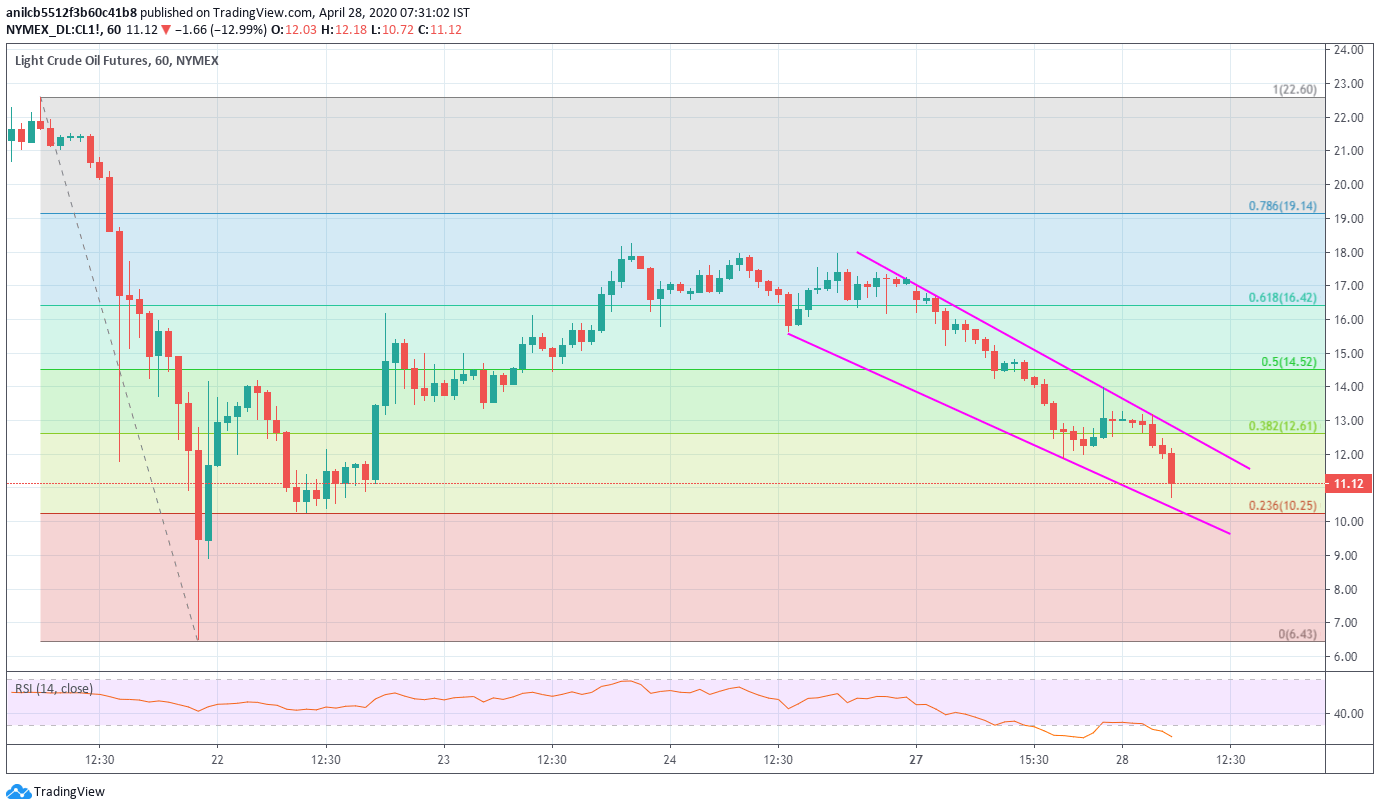

- A two-day-old falling trend line, 23.6% Fibonacci retracement can offer immediate support.

- Buyers will wait for a sustained break above $13.00 for fresh entries.

NYMEX WTI for June futures drop over 13.00% while flashing a sub-$11.00 mark, currently 12.13% down on a day to $11.22, during the early trading hours on Tuesday.

Even if oversold RSI conditions keep signaling intermediate pullback, the overall bearish sentiment seems to target a re-test of a two-day-old support line, at $10.40 now.

Should there be a further downside of the black gold below $10.40, 23.6% Fibonacci retracement of April 21 fall, near $10.25, followed by a $10.00 psychological magnet will be the keys for sellers.

In a case where the bears dominate past-$10.00, the previous week’s low near $6.50 will return to the charts.

Alternatively, an immediate falling resistance line near $13.00 guard the energy benchmark’s short-term recovery moves, a break of which can escalate the pullback towards $15.65 and 61.8% Fibonacci retracement near $16.40.

WTI hourly chart

Trend: Bearish