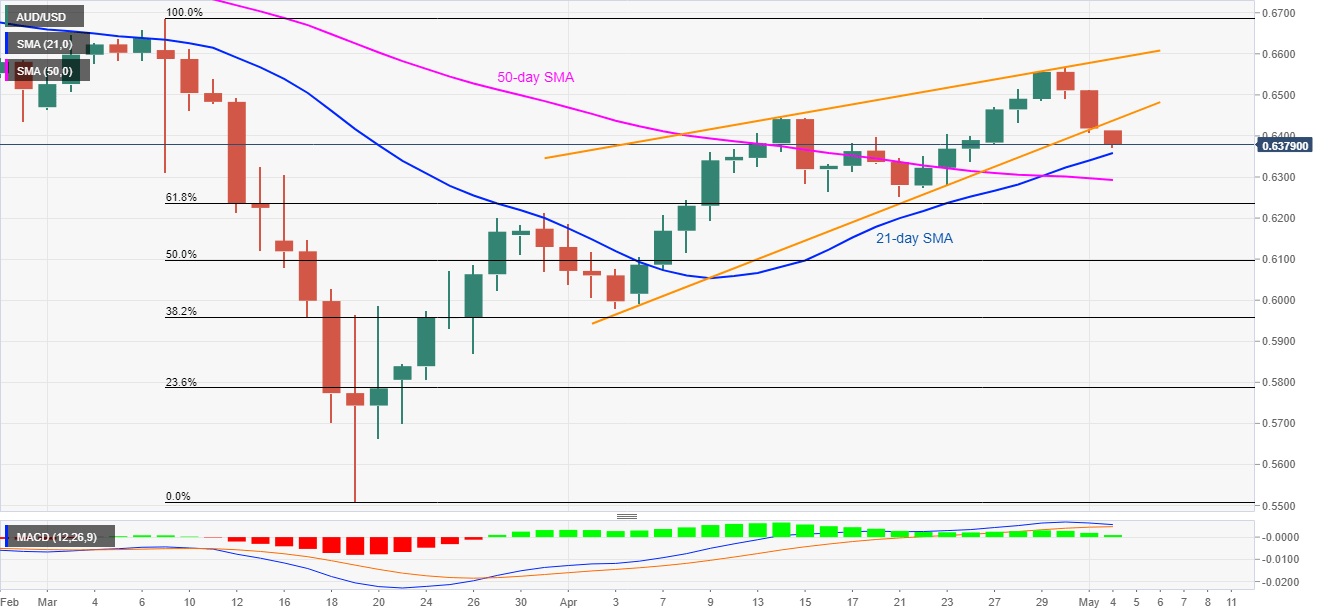

AUD/USD Price Analysis: Heavy below 0.6400 on confirming short-term rising wedge amid Yuan’s drop

- AUD/USD declines to seven-day low after confirming a short-term bearish technical pattern.

- China’s offshore Yuan drops to the six-week low against the US dollar.

- 21-day SMA acts as the immediate support ahead of 61.8% Fibonacci retracement.

AUD/USD extends the early-Asian session south-run while flashing 0.65% loss to 0.6375 amid the early Monday’s trading.

The pair recently confirmed a short-term bearish formation that signals the quote’s slump towards the sub-0.5800 area with 21-day and 50-day SMA, respectively around 0.6355 and 0.6290, acting as immediate supports.

Should Aussie prices decline further below 0.6290, March-end tops surrounding 0.6215 and April month low near 0.5980/75 can entertain sellers.

Meanwhile, an upside clearance of the support-turned-resistance, at 0.6440 now, will have to cross 0.6500 mark ahead of challenging the previous month top near 0.6570.

It’s worth mentioning that the offshore Chinese Yaun (CNH) has a heavy influence over the Australian dollar (AUD). As a result, the USD/CNH surge to the six-week top near 7.15 can be termed as the catalyst for the Aussie pair’s latest drop.

Read: S&P 500 Futures drop 1.5% as US-China tension flares up risk aversion

AUD/USD daily chart

Trend: Further downside likely