USD/MXN Price Analysis: Mexican peso consolidates Banxico-led gains below 24.00

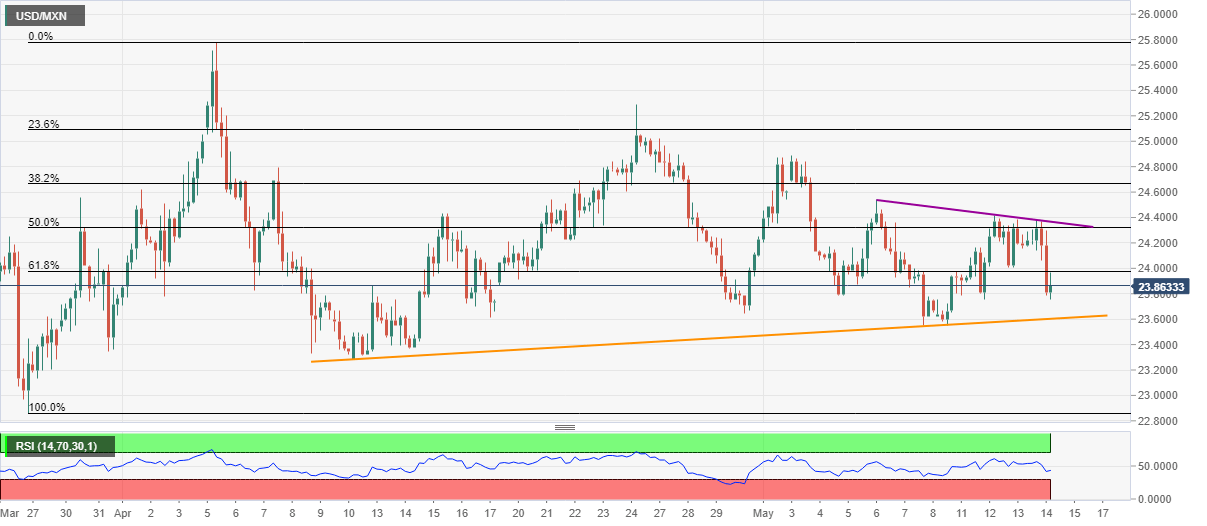

- USD/MXN bounces off three-day low, remains below 61.8% Fibonacci retracement.

- Banxico announced 50 basis points of the interest rate cut to 5.5%, as expected.

- Monthly support line on sellers’ radar, a seven-day-old falling trend line adds to the resistance.

USD/MXN retraces the Banxico-led drop to 23.86 during Friday’s Asian session. Even so, the quote remains below 61.8% Fibonacci retracement of March 26 to April 06 upside.

That said, sellers currently target an ascending trend line from April 12, at 23.60, ahead of probing the monthly low near 23.55.

Should bears manage to ignore RSI conditions post-23.55, April month bottom near 23.28 and 23.00 round-figure may become their favorites.

On the upside, a clear break of 24.00 mark, near 61.8 Fibonacci retracements, can trigger the pair’s recovery moves towards a descending resistance line from May 06, at 24.38 now.

Further, the pair’s sustained run-up beyond 24.38 enables it to challenge the monthly top near 24.98 and late-April peak surrounding 25.30.

USD/MXN four-hour chart

Trend: Bearish