NZD/USD Price Analysis: Eyes a break below 0.6250 amid a potential rounding top

- NZD/USD extends correction from three-month tops above 0.6300

- Dollar stages a tepid comeback amid mixed market sentiment.

- Technical set up suggests a bearish break in the near-term.

Having hit a new three-month high at 0.6308 in early Asia, NZD/USD extends the corrective slide below the 0.6300 level, as the USD bulls jump back on the bids amid a cautious trading environment.

The risk sentiment is souring in the last hour, mainly undermined the renewed US-China trade concerns and escalating civil unrest in the US, in lieu of the black man George Floyd’s death last week. Further, the lackluster performance across the commodities’ board fails to impress the NZD bulls.

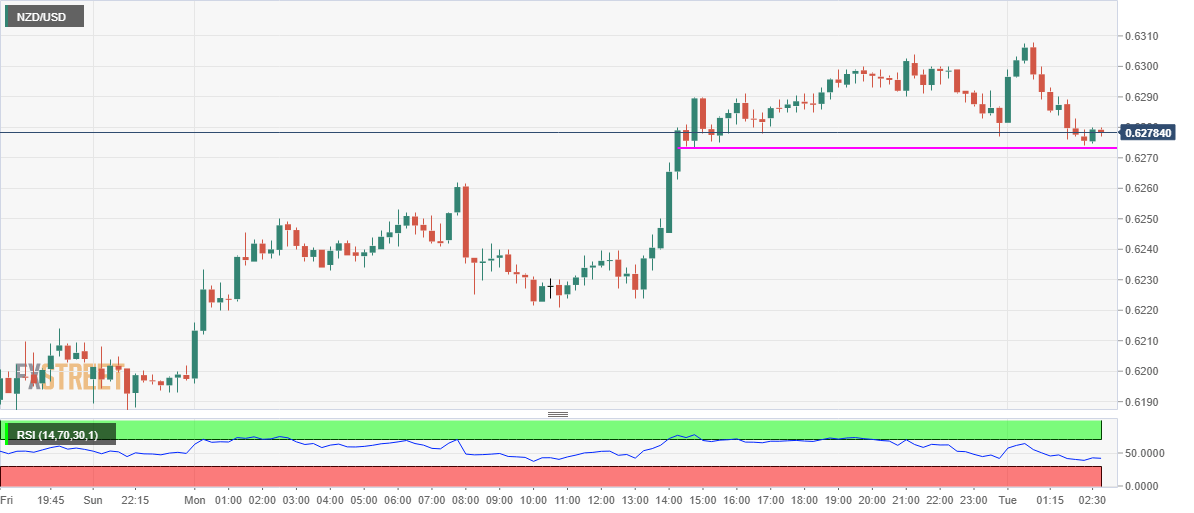

From an intraday trading perspective, technically, the price has charted a potential round top formation on the 15-minutes sticks, with the bears now teasing a breakdown at 0.6273. The pattern will get validated below a break of the latter, opening floors for a test of the 0.6250 psychological level en route the pattern target at 0.6238.

Should the bulls manage to hold above the aforesaid horizontal trendline support at 0.6273, a bounce-back towards the multi-month tops cannot be ruled.

However, with the Relative Strength Index (RSI) trending below the midline and pointing southwards, the path of least resistance appears to the downside in the spot.

NZD/USD: 15-minutes chart

NZD/USD: Additional levels