Gold Price Analysis: XAU/USD consolidates gains above $1,800 inside immediate rising channel

- Gold bulls catch a breather after refreshing the multi-year top beyond $1,800.

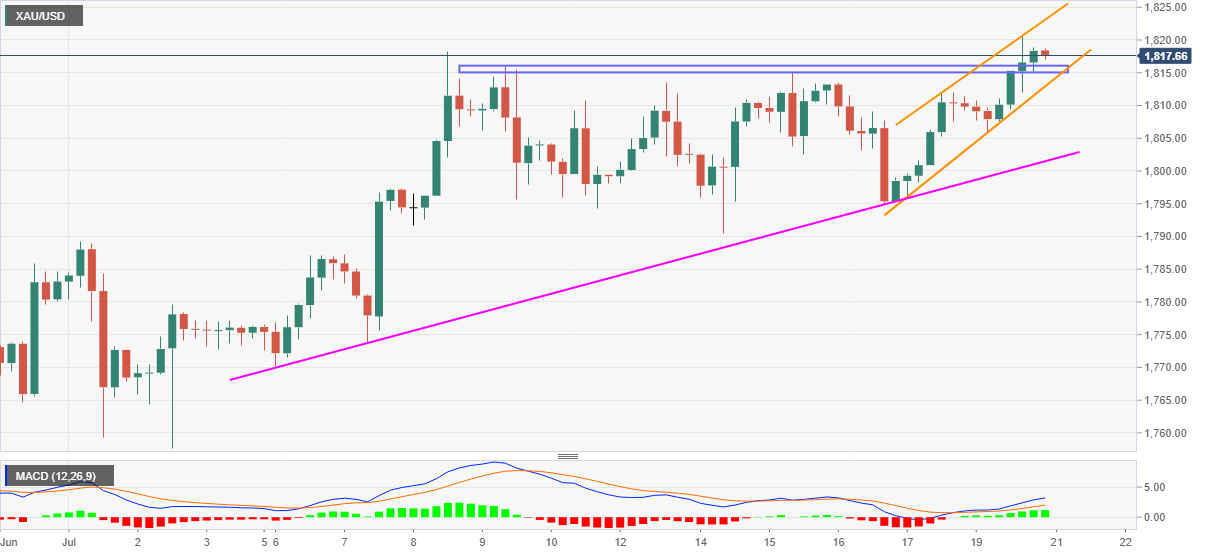

- The upper line of a two-day-old ascending trend channel holds the key to late-August 2011 highs.

- An upward sloping trend line from July 06 adds to the downside barrier.

Gold prices seesaw around $1,818/17 during the early Tuesday morning in Asia. The yellow metal surged to the fresh high since September 2011 the previous day. Favoring the buyers was a sustained break above $1,815/16 horizontal area comprising multiple highs marked since July 09.

With the bullish MACD joining the successful trading past-$1,815, the bullion optimists are less likely to step back. As a result, the quote could remain direct to the north with the upper line of an immediate ascending channel, at $1,823.10, acting as nearby resistance.

If at all the commodity manages to defy the channel formation and rise further, August 30, 2011 peak surrounding $1,840 will be in the spotlight.

Alternatively, a downside break below $1,815 is less likely to recall the bears as the support line of the mentioned channel, currently around $1,813, could question further downside.

Also acting as strong immediate support will be a two-week-old ascending trend line, at $1,801.50, closely followed by the $1,800 threshold.

Gold four-hour chart

Trend: Bullish