Back

24 Jul 2020

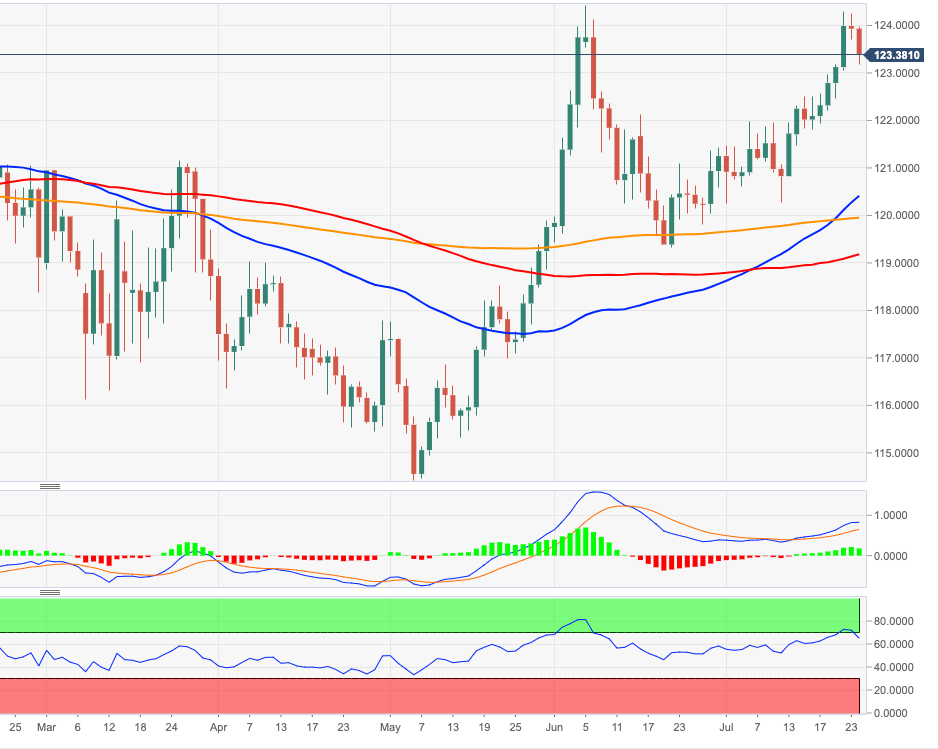

EUR/JPY Price Analysis: Corrective downside could test 122.87

- EUR/JPY intensifies the daily correction well below 124.00.

- Immediately to the downside emerges the 122.87 level.

The rally in EUR/JPY faltered just pips away of the 2020 highs in the 124.40/45 band earlier in the week, sparking the current leg lower soon afterwards.

Extra decline in the cross is likely as it still remains close (but not into) the overbought territory. The ongoing leg lower is seen as corrective only and it carries the potential to extend to January’s peak at 122.87. Once ended the leg lower, EUR/JPY is expected to re-shift the attention to the 2020 peaks beyond the 124.00 mark in the very short-term horizon. Once this area is cleared, the focus should shift to the May 2019 high at 125.23 (May 1).

As long as the 200-day SMA at 119.91 holds the downside, the outlook on the cross is seen as positive.

EUR/JPY daily chart