Gold Price Analysis: XAU/USD eyes $1,860 after Moderna's vaccine news – Confluence Detector

Gold has been losing ground after Moderna reported that its COVID-19 vaccine is 94.5% efficient. The Massachusetts-based pharmaceutical company follows in the footsteps of Pfizer and BioNTech, which announced a 90% efficacy last week. Additional efforts by AstraZeneca, Johnson&Johnson, and CureVac are eyed.

The growing chances of a quick exit from the covid crisis imply that less fiscal and monetary stimulus would be needed. In turn, the precious metal would have fewer funds to rise on.

How is XAU/USD positioned after the second coronavirus vaccine report?

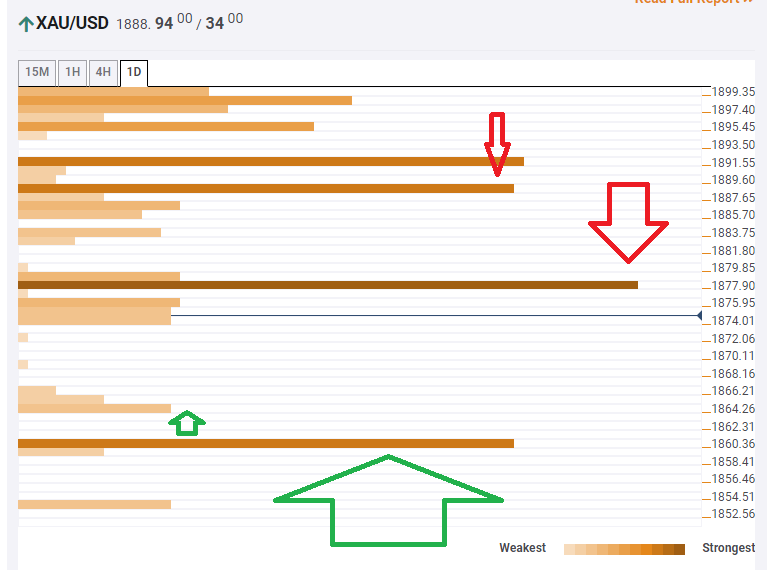

The Technical Confluences Indicator is showing that gold is facing fierce resistance at $1,877, which is the convergence of the Bollinger Band 1h-Lower, the Fibonacci 23.6% one-month, and the Fibonacci 23.6% one-week.

Further above, another hurdle awaits at around $1,889, which is where several lines hit the price. These include the Simple Moving Average 50-15m, the Fibonacci 23.6% one-day, and the Fibonacci 38.2% one-month.

Looking down, weak support awaits at $1,865, which is a confluence area including the Pivot Point one-day Support 2 and the previous 4h-low.

It is followed by a critical cushion at $1,860, which is where the Fibonacci 61.8% one-day meets the previous month's low.

All in all, resistance is stronger than support, pointing to further downside.

Key XAU/USD resistances and supports

Confluence Detector

The Confluence Detector finds exciting opportunities using Technical Confluences. The TC is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. Knowing where these congestion points are located is very useful for the trader, and can be used as a basis for different strategies.

Learn more about Technical Confluence