US Dollar Index Price Analysis: DXY bulls await a move beyond Friday's swing high

- USD Index seemed struggling to build on the weekly bullish gap opening.

- Retreating US bond yields turned out to be the only factor capping gains.

- The near-term set-up still seems tilted firmly in favour of bullish traders.

The US dollar index (DXY) kicked off the new week on a stronger footing and albeit struggled to build on the bullish gap opening and remained below Friday's swing highs. The index was last seen hovering around the 92.00 mark, up 0.10% for the day.

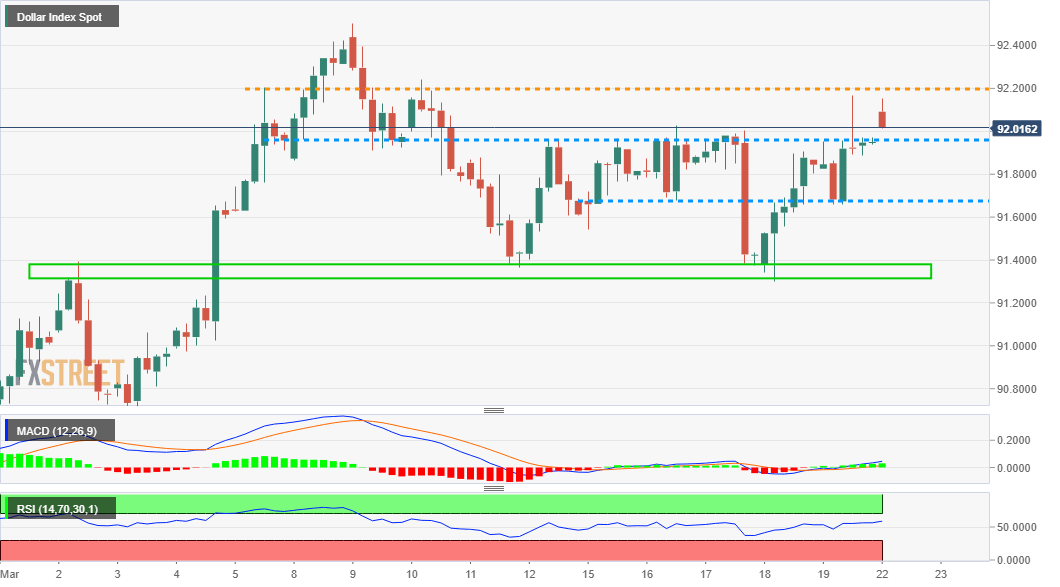

Looking at the technical picture, the post-FOMC USD sell-off stalled near the 91.35-30 support zone. A subsequent move back above the 91.70 horizontal resistance level favours bullish traders and supports prospects for a further near-term appreciating move.

The constructive set-up is reinforced by the fact that technical indicators on hourly/daily charts have been gaining positive traction. However, retreating US Treasury bond yields seemed to be the only factor holding the USD bulls from placing fresh bets.

This makes it prudent to wait for a sustained move beyond the 92.15 area before positioning for any further appreciating move. The index might then aim to challenge a near six-month-old descending trend-line resistance, currently near the 91.30-35 region.

A sustained move beyond will mark a fresh bullish breakout and set the stage for an extension of the recent upward trajectory witnessed over the past one month or so. The index might then surpass monthly tops, around mid-92.00s and aim to reclaim the 93.00 mark.

On the flip side, any meaningful pullback below the 91.90 area now seems to find decent support near the 91.70 region. Failure to defend the mentioned level might prompt some technical selling and accelerate the slide back towards the 91.35-30 region.

DXY 4-hourly chart

Technical levels to watch