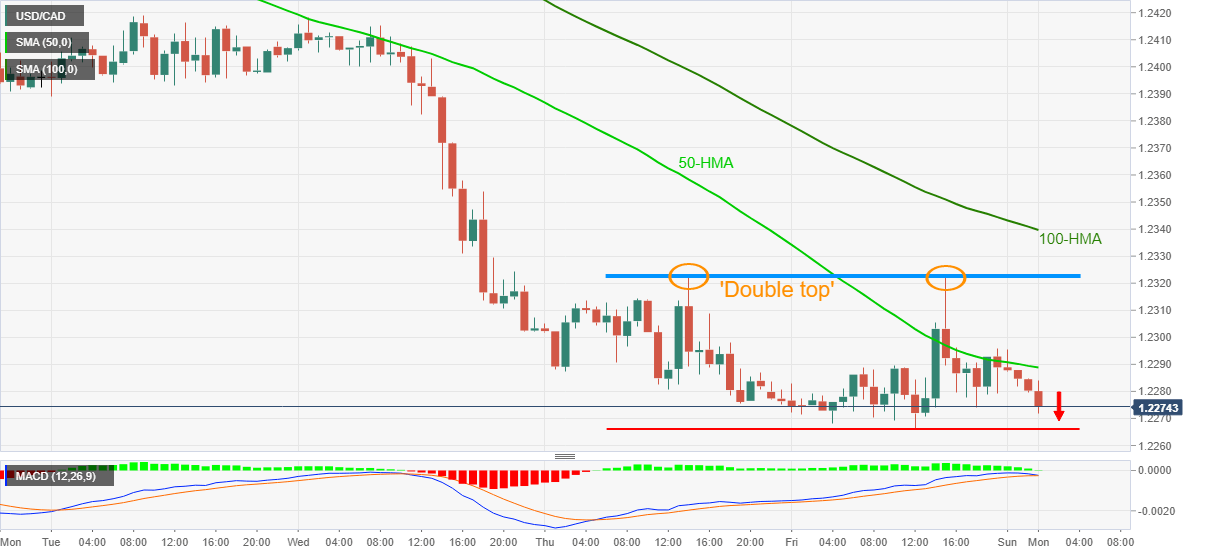

USD/CAD Price Analysis: Bears look to confirm ‘double-top’ formation below 1.2300

- USD/CAD fails to extend Friday’s corrective pullback, attacks support line of a bearish chart formation.

- Receding bullish bias of MACD, sustained trading below key HMAs favor sellers.

USD/CAD remains depressed around 1.2275, down 0.14% intraday, amid early Monday. In doing so, the loonie pair rejects Friday’s bounce-off January 2018 low.

Given the recently easing bullish bias of MACD, coupled with the pair’s trading below 50 and 100-HMAs, USD/CAD stays on the bear’s radar. However, a clear break below the recent low of 1.2266 becomes necessary to confirm the bearish chart pattern, namely ‘double top’.

Following that, the theoretical target of 1.2210 and the 1.2200 threshold could lure USD/CAD sellers while the yearly 2018 bottom surrounding 1.2250 can offer an intermediate halt during the fall.

Alternatively, 50-HMA and the double-tops, respectively around 1.229 and 1.2325, guard the pair’s short-term recovery moves.

Also acting as an immediate upside barrier is the 100-HMA level of 1.2340, a break of which will propel USD/CAD prices towards the 1.2400 round figure.

USD/CAD hourly chart

Trend: Bearish