Back

18 May 2021

Crude Oil Futures: Upside losing momentum?

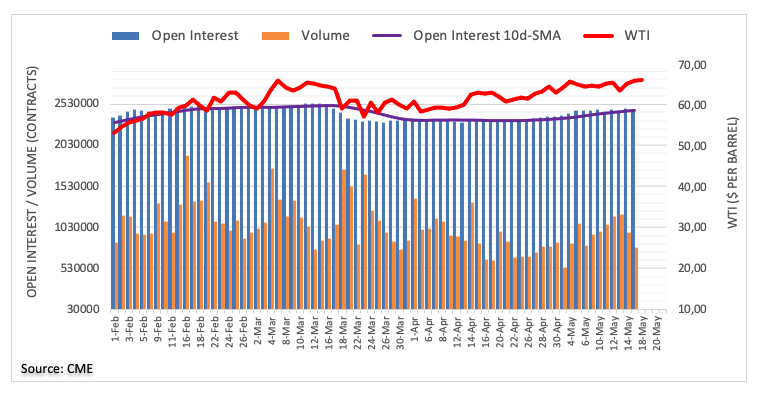

In light of flash prints from CME Group for Crude Oil futures markets, traders scaled back their open interest positions by around 28.5K contracts at the beginning of the week, the largest single-day drop since March 19. Volume, in the same line, shrunk by around 192K contracts, reaching the second daily drop in a row.

WTI capped around $68.00

Prices of the WTI started the week on a positive footing, advancing above the $66.00 mark per barrel. The move, however, was in tandem with shrinking open interest and volume, exposing some exhaustion of the uptrend and opening the door to a probable correction lower in the very near-term.